New Vehicle Sales June 2025

Australia’s new car market slowed down in April 2025, with vehicle sales dropping by 6.15 per cent to 91,316 units compared to the same time last year. Year to date, sales are down by 3.63 per cent on the same period in 2024.

PHEVs saw a significant decline following the removal of the FBT exemption, with their market share dropping to 2.9% in April 2025, down from 4.7% in March 2025. In contrast, BEVs accounted for 5.9% of the market. Chinese EV brands BYD and Chery recorded impressive sales, selling 3207 and 2287 units and securing ranks 12th and 14th overall, respectively.

Toyota continues to lead with 77,177 units sold year to date, followed by Mazda and Ford at 31,692 and 28,733 respectively. Once again, Toyota RAV4 is the most popular vehicle of choice, with 17,610 sales year to date.

The AADA has assessed VFACTs and EVC Top 10 Makes & Models YTD, ranking them by volume. The AADA has also analysed new vehicle sales figures by state for the month of April, as well as fuel types and market segments.

Join us this February for a AADA-BDO Webinar on – The Impact of Mandatory Sustainability Reporting on Australian Dealerships.

Starting 1 January 2025, mandatory sustainability reporting, including the measurement and disclosure of carbon footprint information, became a requirement in many Australian organisations’ annual reports. This webinar will focus on the automotive industry and cover:

Date: Wednesday 12 February 2025

Time: 11am AEDT

Presented by:

The December edition of the Automotive Insight Report (AIR) shows that the used car market observed a 3.8% drop in supply after months of oversupply, with listings falling to 322,532. However, the market continues to favour buyers with sales observing a significant decline of 8.1% to 181,724, offering consumers ample opportunity to strike a good deal during the festive period.

“Average days to sell have increased to 48.7, the highest since October, suggests that sellers are dealing with slower moving stock. This trend is expected to continue in 2025 as the growing oversupply of new vehicles creates a spillover effect into the used car market,” said AADA CEO James Voortman.

“All states but Northern Territory and Western Australia experienced a fall in the number of cars listed for sale,” he said.

Retained values remain on the downward trajectory, with almost every vehicle segment across every age category experiencing a drop in value for the month, with the exception of LCV-Utes in the 2-5 year age categories. Oversupply of new vehicles is negatively impacting retained values for used EVs as well, potentially prompting sellers to hold on to their vehicles for shorter periods of time.

“Average days to sell a used EV have returned to August levels, with Western Australia and South Australia experiencing increased demand, as reflected in a 19.8% and 10.7% rise in EV sales, respectively,” said Mr Voortman.

In the passenger segment, the Ford Mustang holds value best at 97.0% in the 2-4 year age category while the Toyota Yaris maintains top spot at 97.5% in the 5-7 year age category. In the SUV category, the Suzuki Jimny continues to hold top spot at 110.7% in the 2-4 year but is replaced by the Toyota Landcruiser in the 5-7 year old category at 87.9%.

HIGHLIGHTS FROM THE AIR FOR DECEMBER

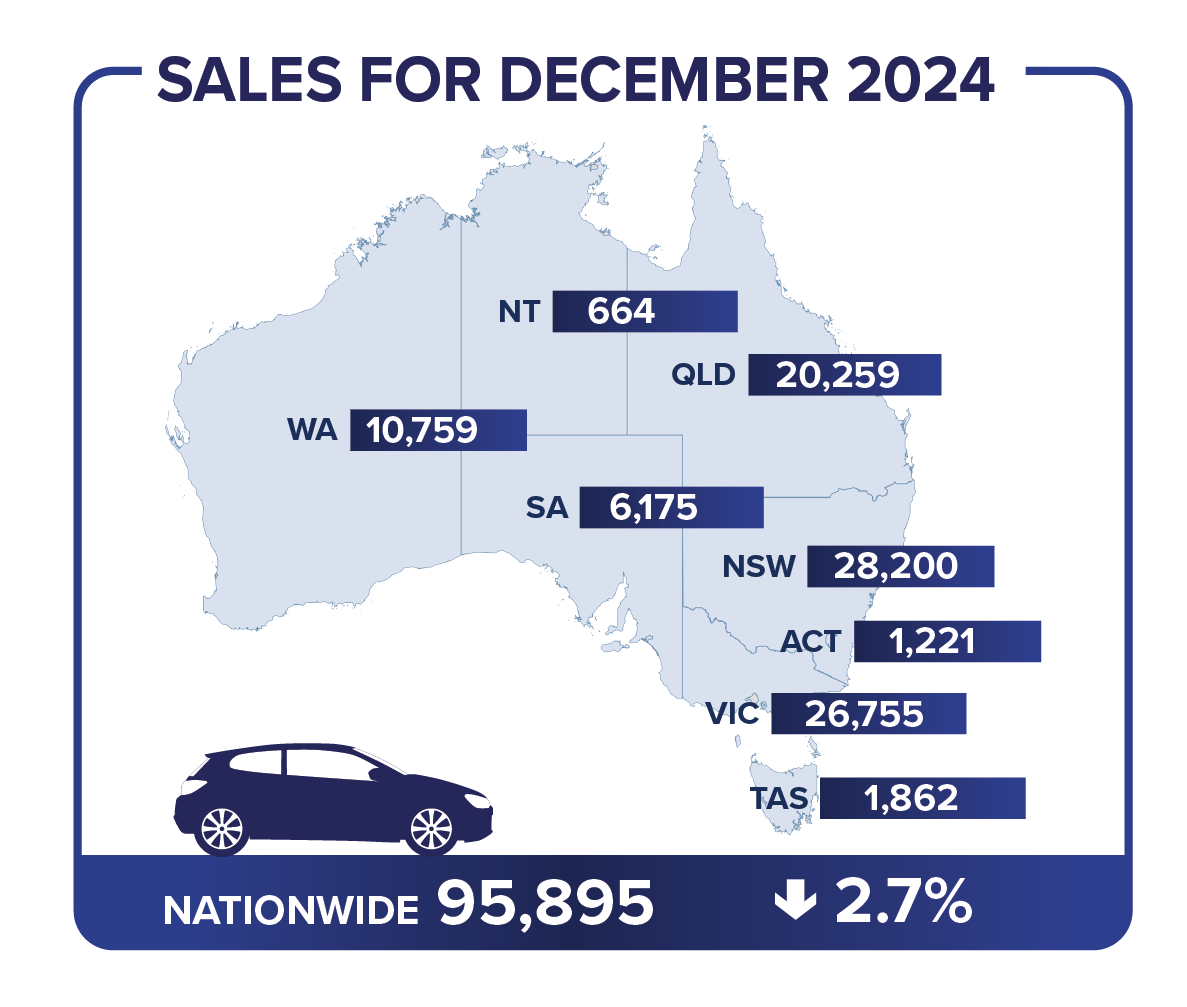

VFACTS for December 2024 and the full calendar year were released this week by the Federal Chamber of Automotive Industries.

New car sales in 2024 surpassed the previous record set in 2023, observing a 0.3% increase to 1,220,607 sales. While rising cost-of-living pressures led to a 2.7% drop in December 2024 sales compared to the same time last year, the overall growth for the year could be attributed to the influx of more affordable Chinese vehicles into the market.

Toyota retained its top spot for 2024, selling 241,296 cars. Despite the arrival of new makes, Toyota remains the most popular car brand for the year, increasing its market share from 17.7% in 2023 to 19.8% in 2024. The top four brands remained unchanged, with Ford (100,170), Mazda (95,987), and Kia (81,787) following Toyota’s lead. Meanwhile, Hyundai was replaced by Mitsubishi in fifth place with 74,547 sales.

While Battery Electric Vehicles (excluding Tesla and Polestar sales from July 2024) recorded a decline in sales by 14.5% compared to 2023, consumers are increasingly opting for fuel efficient vehicles with sale of hybrid vehicles rising by 76% to 172,696 units sold in 2024.

Across vehicle types, consumers continue to hold a strong preference for SUV and light commercial vehicles, collectively representing around 79% of total sales.

With the New Vehicle Efficiency Standard (NVES) commencing this month, 2025 is expected to be a challenging year for the industry as Dealers and OEMs respond to the changing policy environment while continuing to maintain business viability.

The AADA has assessed VFACTs Top 10 Makes & Models YTD, ranking them by volume. The AADA has also analysed new car sales figures by state for both the month of December and YTD, as well as fuel types and market segments.

The November edition of the Automotive Insight Report (AIR) indicates an ongoing cooling demand for used cars, with sales experiencing a decline of 2.3% to 197,652 compared to last month. In contrast, used car listings continue to grow, rising by 5.4% to 335,148 in November.

“This trend is likely to persist as more affordable new vehicles enter the market, prompting buyers to upgrade sooner and increasing the supply of used cars, which will affect price sensitivity,” said AADA CEO James Voortman.

“While the average days to sell have dropped to January levels, they remain higher compared to other months, except October,” he said.

“The Northern Territory stands out among the states, with a tight market reflected by a 30.5% increase in sales and a 12.3% decline in listings,” said Mr Voortman.

“Sales have declined across all fuel categories, with EVs experiencing the largest drop (down 8.3%), followed by PHEVs (down 7.4%). This could be attributed to the growing supply of cheaper new BEV and PHEV vehicles entering the market, expanding used-car inventory and driving up holding costs,” he said.

Retained values continue to steadily decline, with almost every vehicle segment across every age category experiencing a drop in value for the month, with the exception of passenger vehicles in 3-4 year old category. On the other hand, retained values of used EVs in the 5-year-old category have declined by 4.7% to 48.5% in November compared to October, reflecting the slowing demand for used EVs.

In the passenger segment, Audi RS3 retains value the most at 97.4% in the 2-4 year old category while the Toyota Yaris continues to lead at 95.3% in the 5-7 year-old category. In the SUV category, the Suzuki Jimny retains top spot in both the 2-4 year and 5-7 year old category at 111.3% and 110.1% respectively.

“While the average time to sell a used EV has dropped to 61.6 days (down from 67.3 last month), this is still much higher than the beginning of the year, where days to sell sat in the low to mid 50s. This can be linked to the rising supply of used EVs, as observed across all states but the Northern Territory, where supply is significantly outpacing demand, presenting consumers with more options,” said Mr. Voortman.

HIGHLIGHTS FROM THE AIR FOR NOVEMBER

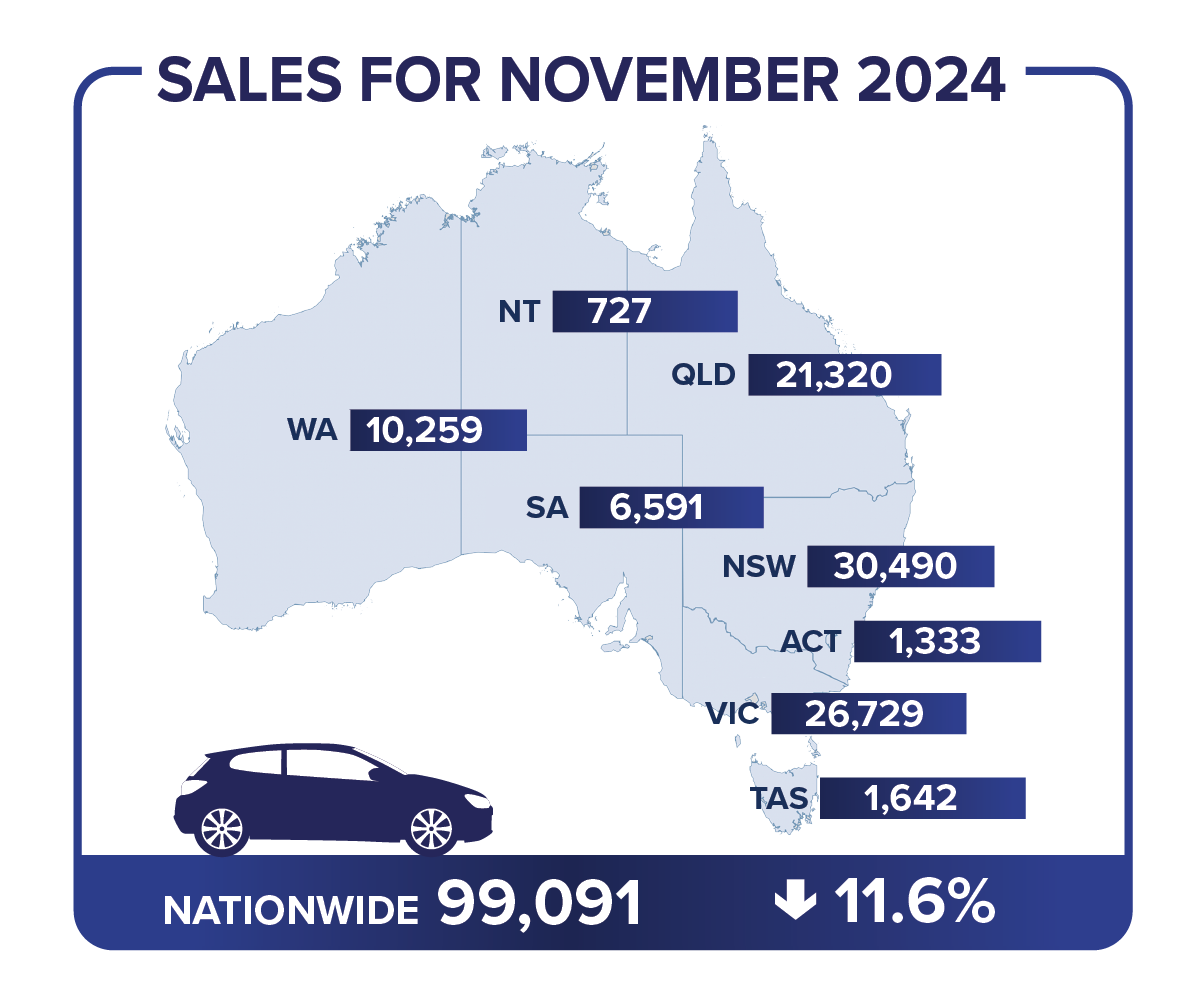

New car sales figures released by the Federal Chamber of Automotive Industries indicate an ongoing softening demand for new vehicles with sales declining by 11.6% to 99,091 in November compared to same month last year. Year-to-date, sales are up by 0.6% on the same period in 2023.

Private buyers struggle amid rising cost of living pressures reflected by the drop in sales by 16.6% in that segment. Consumer preferences for SUVs and Light Commercial vehicles remain clear, with Ford Ranger, Toyota RAV4 and Toyota Hilux ranking as the top 3 models year-to-date. Across fuel types, Hybrid and PHEVs continue to be a favourable option as brands and consumers adapt to evolving emission standards.

The AADA has assessed VFACTs Top 10 Makes & Models YTD, ranking them by volume. The AADA has also analysed new car sales figures by state for both the month of November and YTD, as well as fuel types and market segments.

CarExpert launched its annual “Road to Purchase” report analysing new car buyer trends and behaviour. The launch included a panel discussion featuring AADA CEO James Voortman and Kirsten Riolo, Head of Publishers and Platforms at Neilsen, who provided valuable insights into the consumer perceptions and where the industry was heading in 2025.

Watch the full recording and access the presentation and report below:

With the holidays and festive period approaching, its about time to start wishing everyone a very Merry Christmas and a Happy New Year!

The AADA offices will be closed from Tuesday 24 December 2024 and will reopen on Monday 6 January 2025.

Should any urgent matter arise, please contact AADA team member:

Brian Savage

Company Secretary & Deputy CEO

Australian Automotive Dealer Association

E: bsavage@aada.asn.au

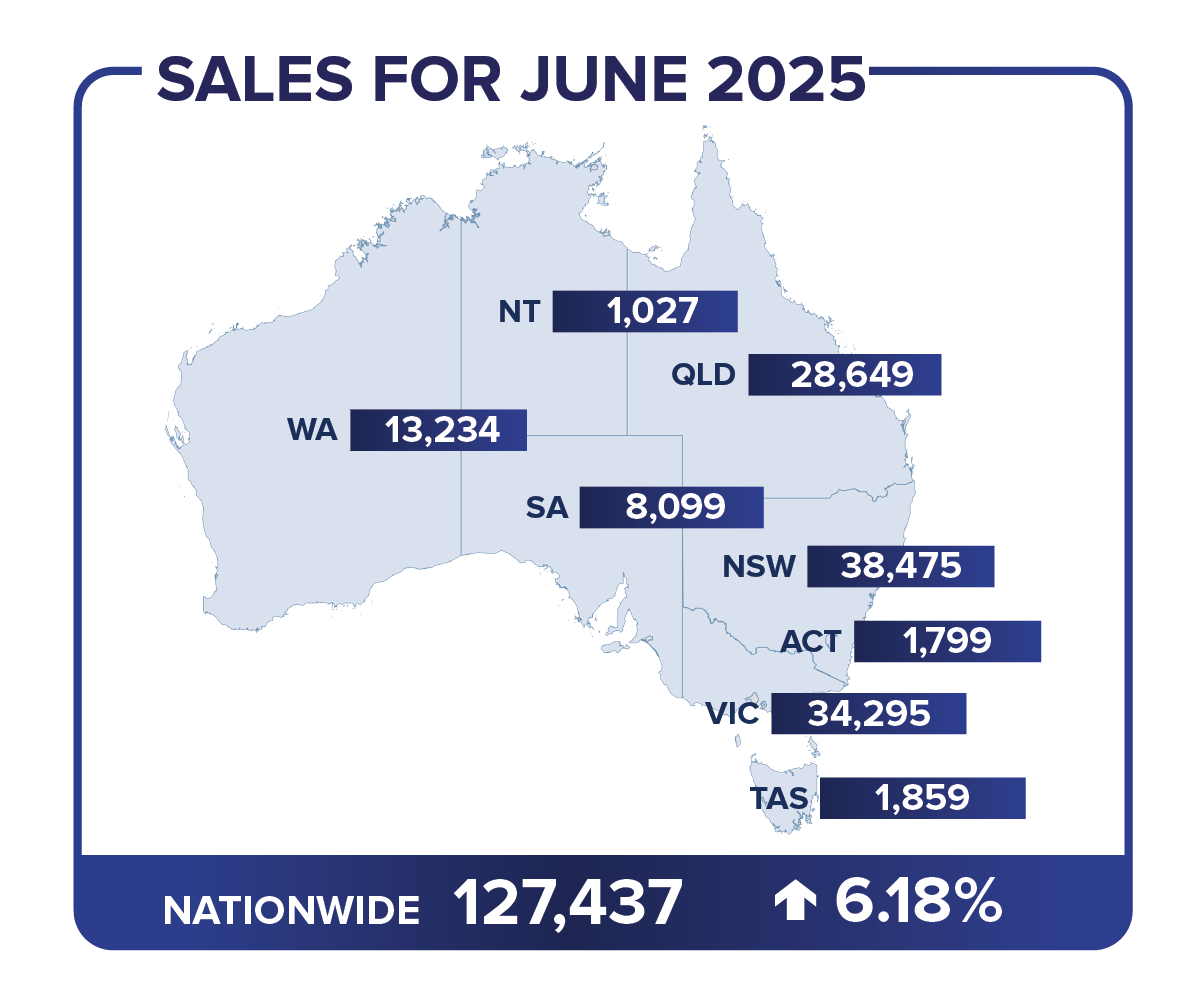

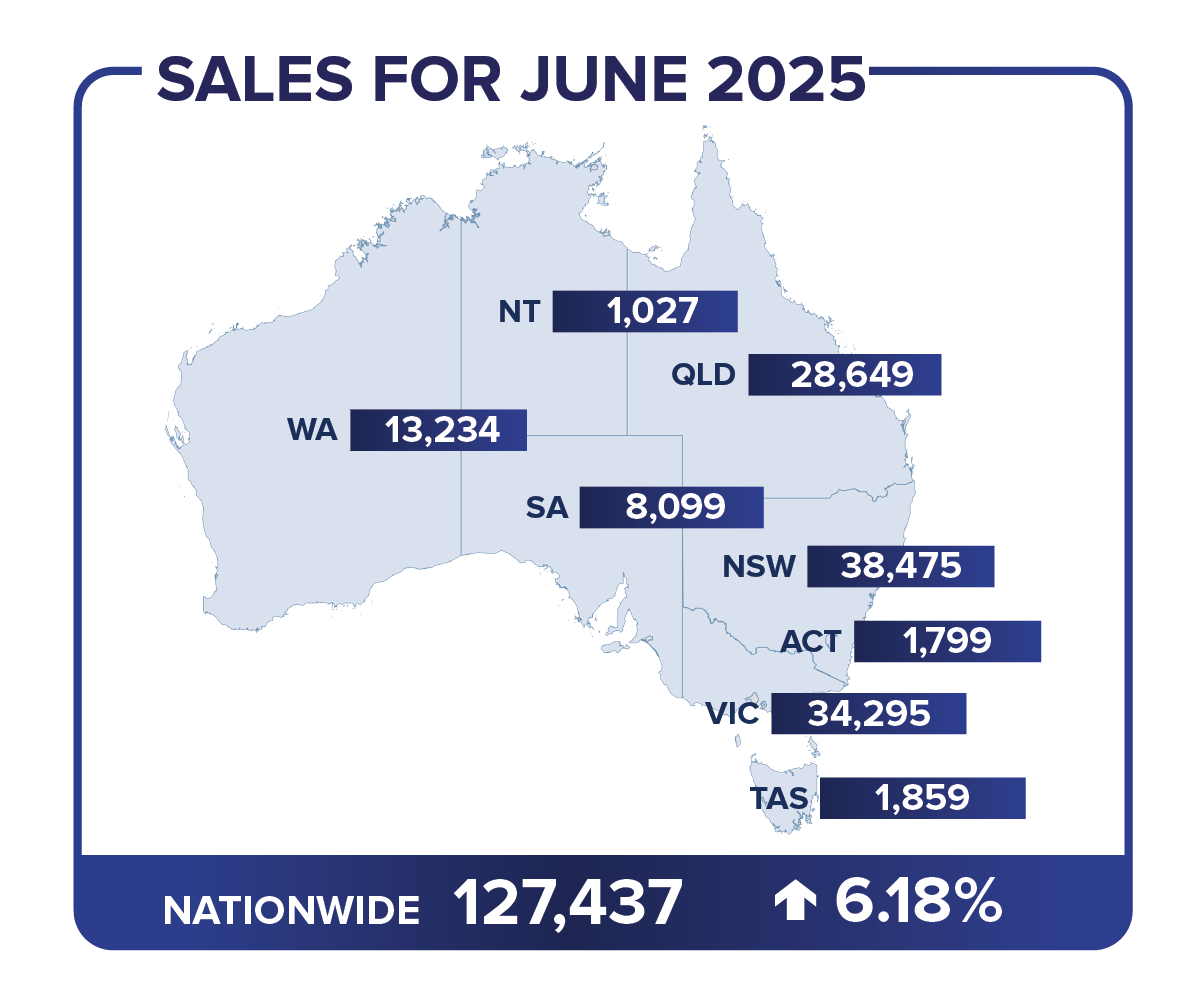

New car sales in Australia increased by 6.18 per cent in June compared to the same month last year, potentially driven by consumers taking advantage of end-of-financial-year discounts. Year to date, sales remain down by 1.42 per cent on the same period in 2024.

Key highlights include:

➡️ Chinese brand BYD continues to grow in popularity, recording a dramatic 367.9 per cent increase in sales, with 8,156 units sold in June 2025 compared to 1743 in June 2024.

➡️ Utes and SUVs once again dominated buyer preferences, taking all ten spots in the list of top-selling new vehicles.

➡️ While Chinese carmakers are on the rise, Toyota remains the market leader, selling 20,225 vehicles in June, reflecting continued brand loyalty in Australia. Toyota was followed by Ford (10,103 units) and Mazda (9,405 units).

The AADA has assessed VFACTs and EVC Top 10 Makes & Models YTD, ranking them by volume. The AADA has also analysed new vehicle sales figures by state for the month of June, as well as fuel types and market segments.